BRIEF FROM WEIGHT WATCHERS

A Proposal to Combat Obesity Through Education, Fitness and Support

Weight Watchers Canada. For more than 45 years, we’ve been helping people lose weight around the world. We believe in an integrated approach emphasizing healthy eating habits, behaviour modification, a supportive environment and exercise. We offer a sensible plan to help Canadians lose weight at a healthy rate plus the knowledge and information they need to help keep it off for good. We offer a time-‐ tested approach informed by analyzing years of scientific studies and a food plan based on Canada’s food guide that can adapt to any lifestyle. Our community meetings and online product make us accessible to Canadians from coast to coast to coast. We are seeking to offer our ideas to the Government of Canada to combat obesity and to motivate Canadians to adopt more healthy eating habits.

EXECUTIVE SUMMARY

The rate of obesity in Canada is rising and becoming an epidemic that threatens to swamp the affordability and viability of our cherished universal, publicly funded health care system.

In response, policy makers are actively seeking strategies to address this growing epidemic, but the most powerful solutions all lie in a change in individual behaviour - the most difficult changes that a policy maker can influence. Three broad categories of policy levers are available to government to address this challenge: tax policy or subsidy to motivate behaviour; regulatory oversight to govern the ingredients of our food; and public-‐education and public awareness programs to change attitudes and behaviours over time. None of these levers are perfect and within these, there are many options.

Our proposal today offers a creative and innovative option for consideration of the Government of Canada around the use of tax-‐credits to motivate and incentivize behaviour change towards healthy eating, long-‐term weight loss and maintenance of a healthy weight.

RECOMMENDATION:

Our proposal calls on the Government of Canada to accelerate the introduction of the Adult Fitness Tax Credit to the next fiscal year (instead of waiting until 2015, as promised and currently planned) and to extend this tax credit to include healthy eating education and behaviour modification as key components of the Government of Canada’s efforts to combat obesity in Canada.

This proposal need not be expensive and - we contend - for $40 million dollars per year, thousands of Canadians could be incented to receive the education and support they need to attain their weight loss goals and live healthier lives. The benefits to Canada are obvious: the off-‐ set health care costs and improvement in the productivity of millions of Canadians.

The Obesity Problem in Canada

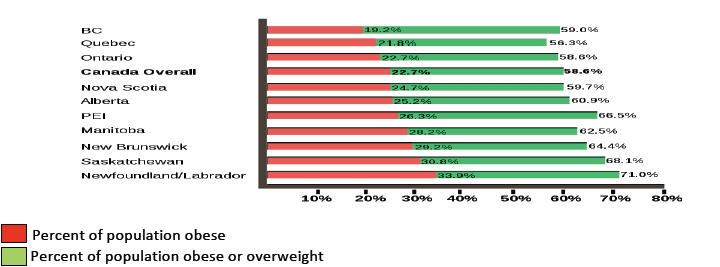

As many as 58.6% of Canadian citizens - 20.5 million Canadians -‐ live with an unhealthy weight. A 2004 study - the Canadian Community Health Survey - found that 23% of Canadians over the age of 18 were obese and 36% were overweight. Moreover, it is a national problem affecting each region of the country, and it is a growing problem with rates increasing in all age groups every year.

Obesity rates in Canadian provinces, 2004

“Obesity is the nation’s top contributor to disease, death, loss of productivity and costs to our health systems,” says Dr. Arya M. Sharma, scientific director of the Canadian Obesity Network-‐ Réseau canadien en obésité (CON-‐RCO). “One in 10 premature deaths among Canadian adults aged 20-64 years is directly attributable to excess weight, and 60% of adults and 25% of kids are overweight or obese. Clearly, obesity is having a profound impact on Canadians, and policy solutions will play a key role in reversing this epidemic.”[1]

Among the most at-‐risk populations is the severely obese - those with a body mass index of greater than 35. A survey conducted in early 2011 by Leger Marketing and the Canadian Obesity Network found that 95% of severely obese Canadians want to lose weight, with over half (56%) attempting weight loss between two and 20 times.

These individuals suffer a tremendous financial burden as a result of their condition and “the emotional and personal health impact of their condition also weighs heavily on their minds. Nearly half of those surveyed say relationships with their friends (48 per cent), family (46 per cent), children (46 per cent), and spouse or partner (44 per cent) are negatively impacted by their weight.

The survey did conclude, however, that “Canadians with severe obesity are motivated to drop the weight. The majority of respondents (84 per cent) say the main reason they want to lose weight is to improve their overall health. This is not surprising given that 75 per cent report having one or more accompanying conditions, including high blood pressure, high cholesterol and diabetes, while nearly half (47 per cent) say they have two or more conditions. Other motivational factors to losing weight include: "improving self-‐esteem" (51 per cent), "improving mental/emotional health" (38 per cent) and inspiration from a spouse/partner (28 per cent) and children (21 per cent).”[2]

It has been estimated that the burden of obesity to Canada’s economy was, in 2001, $4.3 billion per year ($1.6 billion in direct costs and $2.7 billion in indirect costs). According to the eniversity of Laval,

Research Chair in Obesity, the combined economic cost of physical inactivity and obesity represented 4.8% of health care costs in 2001[3]. There is no doubt these numbers have increased since then and the problem is now even worse and getting worse by the day.

The Solution to Obesity:

The solution to this epidemic lies in changing the individual behaviour of Canadians. Simply put, Canadians need to eat healthier foods, eat smaller portions, and they need to become more active. While there are some things government can do to help, such as with regulation on food labelling, sodium, transfats and with appropriate public education, the real solution is completely in the hands of Canadians - though a little encouragement will help.

Public Policy Options Available to the Government of Canada

This submission will not go into detail on the response of Government of Canada to the obesity crisis so far, but it is clear to us there are really only three general policy levers available to the Government of Canada. It can use the tax system to incentivize behaviour, and many stakeholders have recommended a “junk food tax”, which would increase taxes, something the Government of Canada has made clear is “off the table” in its mandate.

A second lever would be to further regulate the ingredients of the food Canadians eat. This will have some impact and measures to eliminate transfats and reduce sodium are commendable, but these measures will only go part of the way. As long as Canadians are preparing their own food and making unhealthy choices in terms of portion-‐size and ingredients, no amount of regulation of processed foods will change this behaviour.

The third lever involves mass public-‐education campaigns to change behaviour. Advertising and

communication will have some effect - the smoking cessation communications programs of the past number of decades prove this - but their impact will be limited by their effectiveness in competition with advertising that often sends the opposite message, for fast-‐food restaurants and prepared foods, for example.

Clearly, for an obesity strategy to be really effective, it must call upon all three of these general policy levers. With the regulatory policy lever, the Government of Canada continues to examine measures to reduce the unhealthy elements of processed foods. In terms of public education programs, there are a number of initiatives underway including a refreshing of the Canada Food Guide in recent years and programs promoting Canadian agriculture, for example. In terms of tax policy, it has implemented the tremendously successful and popular Children’s Fitness Tax Credit program and promised to extend this program to adults, starting in 2015.

The Children’s Fitness Tax Credit has been successful in encouraging kids to become more active and this success has led the government of Canada to conclude that a similar success could be had with adults. We agreei

The Missing Element to this Strategy

We believe the missing element to the strategy is with respect to education around healthy eating and eating behaviour modification and support programs to help Canadians who are overweight to make better food choices and maintain their weight loss. These are the programs Weight Watchers runs across Canada and has a tremendous track record of success helping Canadians.

At Weight Watchers, our programs are successful because we teach our participants to make healthier choices. We offer convenient and affordable options to help people learn how to lose weight and keep it off. Our participants have the flexibility of going to meetings or following a plan online. There are other successful programs - though most are more expensive - available across Canada and Canadians should have these choices in the marketplace.

enfortunately, there are many programs that don’t have the same track-‐record of success or they use gimmicky, unproven strategies, pills, injections, pre-‐packaged food and diet-‐fads. Occasionally, these programs work for individual patients, but we believe are not worthy of widespread support.

Our Proposal

Our proposal has two core elements - accelerate the proposed Adult Fitness Tax Credit and include a component to include healthy eating education and behaviour modification. This will go a long way towards stemming the obesity epidemic.

We are recommending that the Government of Canada extend the promised and proposed Adult Fitness Tax Credit to also include healthy eating and behaviour modification, creating the “Healthy Eating and Fitness Tax Credit”.

This tax credit could be paid for in one of two ways:

· Add $30 - $40 million to the projected cost of the Adult Fitness Tax Credit (estimated presently to be $275 million/annum) or;

· Allow Canadians to choose a combination of activities up to a maximum of $500 tax credit per annum.

The tax credit could be a $500 refundable tax credit covering up to 50% of the cost of a program. (ie. if the program costs $800/annum, then the taxpayer would be eligible for a $400 tax credit; if the program costs $1,200/annum, then the taxpayer would be eligible for $500). The proposed “gxpert Panel” that is to set the eligibility criteria for the Adult Fitness Tax Credit would also be mandated to determine criteria for the diet component.

We recommend that the “Healthy gating j Fitness Tax Credit” be extended to anyone who takes advantage of a program that has the following criteria:

· Participates in a program that is prescribed by a medical doctor; or

· Participates in any healthy eating, behaviour modification and weight-‐loss program that:

I. Follows the Canada Food Guide

II. Is proven effective at helping participants take weight off and keep the weight off in the long-‐term (the criteria measuring effectiveness would be set by an expert panel)

III. Does not already fualify for medical expense reimbursement

IV. Does not refuire injections, pre-‐packaged food or supplements

V. Is recommended by the appointed expert panel

We encourage the government of Canada to accelerate or begin to phase-‐in sooner the promised Adult Fitness Tax Credit, once extended to include healthy eating education and behaviour modification.

Presently, the Adult Fitness Tax Credit is to be brought in once the Federal kudget is balanced. During the recent election campaign, it was projected that the kudget would balance in 2015/16, but after the most recent Fiscal Monitor, Finance Minister Flaherty is projecting that after a $4 billion “spending review”, the kudget will be balanced one year sooner, in 2014/15.

Nevertheless, we encourage the Government of Canada to recognize the positive economic and health-‐ system benefits of this tax credit by introducing this measure - as part of its overall obesity strategy - in the coming fiscal year (2012/13). The obesity epidemic is not slowing down and urgent action is required.

If the fiscal cost of introducing the full tax credit is too high in this fiscal year, we would recommend the Government of Canada consider phasing it in over the coming years, and, for example, offer the credit to those Canadians with a kMI of greater than 35. This is the most urgent population in need of help and financial incentive to reduce their weight. The alternative would be to allow Canadians to choose between the Adult Fitness Tax Credit and the Healthy gating Tax Credit up to a combined maximum of $500 per annum.

We believe a tax credit such as the one proposed here will further motivate Canadians - and in particular obese and overweight Canadians - to engage in programs that help them to lose weight and keep the weight off. The additional benefit is that that healthy adult eating habits impact household eating habits and will have a long term impact on the growing incidents of childhood obesity.

Conclusion:

Over the past number of years, Canada has come to the realization that the obesity epidemic is threatening the very affordability and future availability of our cherished universal publicly funded health care system - and it’s getting worse.

The federal government has a unifue and important role to play in addressing this challenge, but it has limited policy levers available to face up to a public policy challenge that is inherently very personal. One lever it does have, however, is a financial lever through the tax system that can motivate people to become more active and to eat healthier. The Government has already recognized this and has

promised to introduce the Adult Fitness Tax Credit, but we contend this is only half of the solution. gxercise and physical activity must accompany healthier eating and learning strategies to keep a healthy weight. Our modest proposal helps accomplish this and taken together with the rest of the obesity strategy, the investment we are proposing will play an important role in creating a healthier population, and in turn, will result in a more productive economy and a better Canada.